cayman islands tax treaty

The contributions are tax deductible. See the Other taxes section in the Corporate tax summary for more information.

How To Open An Offshore Bank Account In The Cayman Islands

Special consumption tax SCT.

. With certain exceptions a 30 or lower treaty rate branch profits tax also will be imposed on interest payments by the US branch to foreign lenders. Higher or lower rates of GCT are applicable to certain goods and services. Consumption taxes General consumption tax GCT GCT is a value-added tax VAT and the standard rate is currently 15.

The purpose of the branch profits tax is to treat US operations of foreign corporations in much the same manner as US corporations owned by foreign persons.

Offshore Company In Cayman Islands Fast Offshore

History Of The Cayman Islands Explore Cayman

Letter From Brussels Pressure Builds On Tax Havens Analysis Ipe

Actions Required On Register Of Beneficial Ownership For Cayman Companies Vistra

Lowtax Global Tax Business Portal Double Tax Treaties Introduction

Cayman Islands And Cryptocurrency Blockchain And Cryptocurrency Regulations

Cayman Islands Profile Bbc News

Tiea Between The Cayman Islands The Former Netherlands Antilles To Enter Into Force Orbitax News

Here Are Some Of The Most Sought After Tax Havens In The World

Tax Advice For Uk Citizens Moving To Cayman Cayman Resident

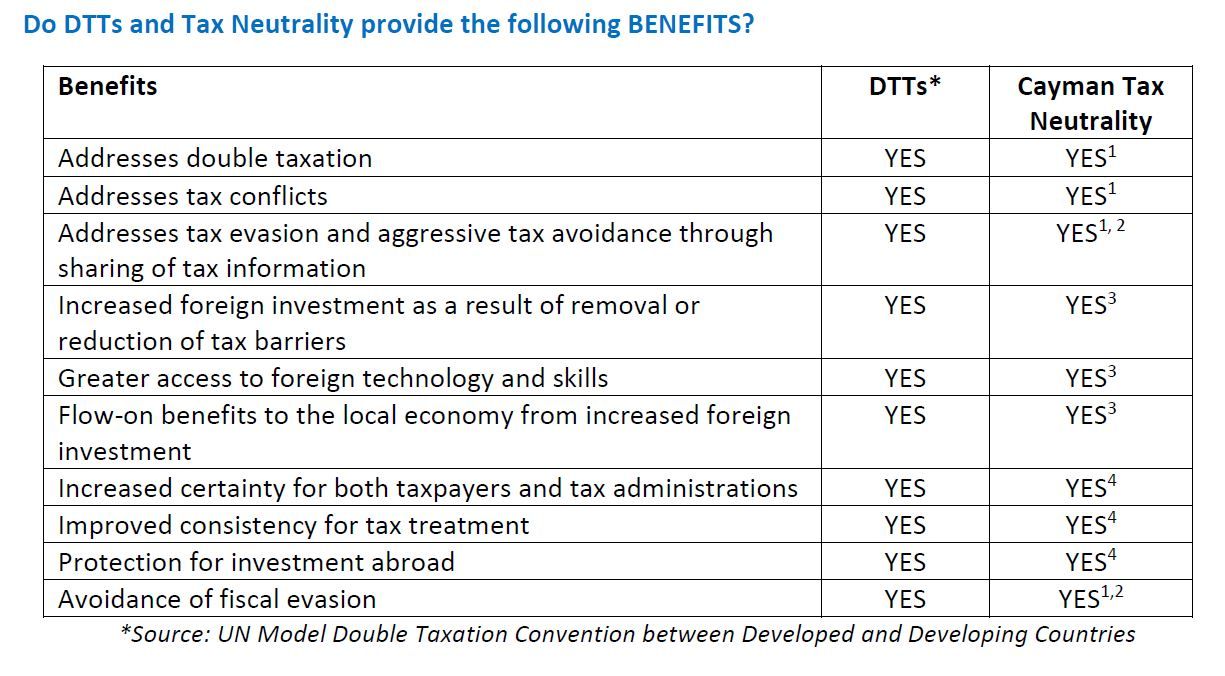

Are The Cayman Islands Tax Neutral Oasis Land Development Ltd

Cayman Islands Tax Neutrality Overview Tax Authorities Cayman Islands

Invade The Cayman Islands Thestreet

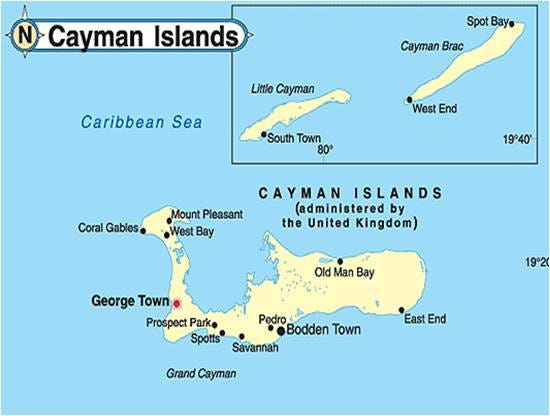

An Overview Of The Cayman Islands By Ben Hinson Countries Around The World

What Makes Cayman Islands So Popular For Hedge Funds International Finance

How To Move Your Business To Cayman And Pay No Tax Escape Artist

Registration Of Company In Cayman Islands Offshore In Cayman Islands Company Registration For Business Purposes Law Trust International